Everyone's heard about the Target controversy involving the swimsuits with "tuck-friendly" construction suitable for gender expressions the retail chain sells for adults, but not, as some conservatives claimed, children. And there's the Bud Light flap caused by the brand's fleeting embrace of Dylan Mulvaney, a popular, flamboyant young transgender “influencer” that ended up diminishing the watery beer's sales. But how many know about the modern investment philosophy, known as "ESG," that's bankrolling this trend?

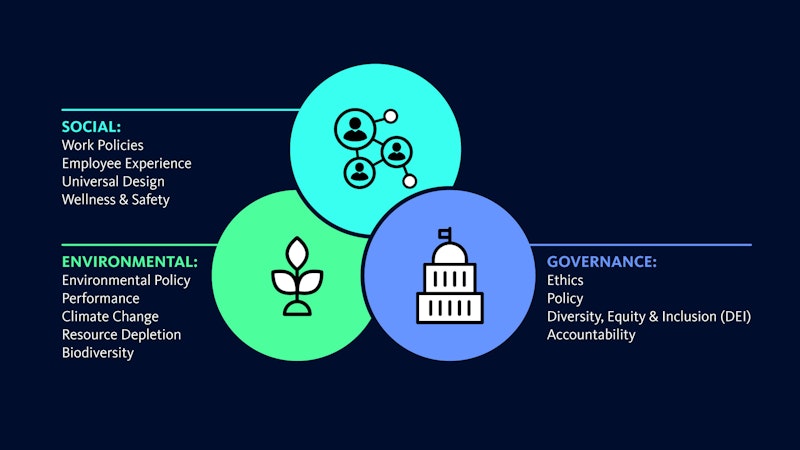

Under the principles of ESG—"environmental, social, and corporate governance"—investors favor corporations they view as good citizens of the world. They reward green corporations (that's the "E"), progressivism on social issues (e.g. tuckable swimsuits and transgender-friendly marketing campaigns ("S"), and for the "G"—diverse corporate boards, stakeholder rights, and company policies and values. You’d think no conservative-leaning corporation would pay much heed to the above criteria, but that’s wrong. Fox News celebrated Pride Month by encouraging its employees to give money to groups that encourage sex changes for minors, and to read a book of gay erotica that explains what a glory hole is.

I’ve no particular opposition to either sex changes for minors—a parent-child decision, or glory holes—but there's an obvious forced quality to pushing such material in a conservative workplace. Are Fox News employees really expected to read gay erotica to show their support for Pride Month? But Fox News is owned by Fox Corporation, which is just as subject to ESG/Big Three pressure as a progressive firm like Disney.

If you're wondering why the above controversies keep popping up—Kohl's was recently in hot water when it sold Pride clothing marketed for infants—follow the money. Our major investment capital firms have placed ESG at the core of their investment choices. So even though the Bud Light boycott was effective at damaging the brand, and Target was forced into some concessions, the massive ESG funding superstructure dwarfs the power of any of potential conservative-backed boycott, which would be up against the Big Three—Black Rock, Vanguard, and State Street—the three largest and most influential financial institutions in U.S. history that control around $20 trillion in assets, almost none of which are their own.

Conservatives are now in the ironic position where their 401k savings are used to promote ideas they oppose. The Big Three, which are committed to ESG, are the largest shareholders of around 90 percent of the biggest firms listed on the S&P 500. The implied threat is they'll sell off their shares if their ESG demands aren’t met, so conservatives have their work to do, even if recent boycott successes have energized them.

Over on the "E" side of ESG, there’s a push to reward green firms with investments while withdrawing funding from brown firms, based on the assumption that the "carrot and stick" approach will work. But if there's any original research supporting this simplistic notion, I've yet to see it. What's indisputable is that association with such a progressive investment strategy makes many feel good, and helps them bond with like-minded individuals who believe they're "on the right side of history."

But how effective is it to funnel cash into finance and insurance companies that are already green and, by the nature of their business, can't get much greener? What would added investment do to make Spotify greener? If the music streamer were able to become twice as green, it would have no effect on the environment, while even a one percent reduction in emissions from a major brown firm would. Raising the cost of capital for a brown firm, which ESG does, will force it to lower its environmental impact? This is the point progressives haven't thought through, because their analysis has been feelings-based rather than economics-based.

Ultimately, brown firms pollute more when they’re punished, according to a study done by Yale School of Management professor Kelly Shue. The professor found that the ESG stick leads them to adhere to current production techniques, rather than going green to appease the Big Three, because that gets them the cash to stave off bankruptcy.

Forcing behaviors doesn't work out well for the environment, and in other realms as well. But tell that to Larry Fink, billionaire CEO of BlackRock, who in a 2017 New York Times interview said, "Behaviors are gonna have to change and this is one thing we're asking companies. You have to force behaviors, and at BlackRock we are forcing behaviors."

Fink did everyone a big favor by spelling out the Big Three's authoritarian agenda in plain English, so we need to believe him. And don't forget Joe Biden is on board. He supports Wall Street imposing a political agenda on the nation with its financial might, which I thought was anathema to the Democrats. The agenda involves forcing CEOs to comply with various ESG-based edicts, or their salaries will be cut. Corporate boards will be forced to choose their boards with a priority on diversity over competence.

It’s conceivable Larry Fink and his tight circle may someday force corporations to have their employees' pronouns attached to their emails. Question: Do we want the tiny group of unelected finance kingpins that controls $20 trillion in pension funds, 401k funds, etc. "controlling" our behavior? Kelly Shue has already demonstrated the folly of that approach on the "E" side, so why would it work out better on the "S" side?